Mobile Payments Market Forecast, 2014-2022

出 版 商:Allied Market Research

出版日期:2017/01/01

Mobile Payment Market Overview:

Mobile Payments Market is projected to grow at a CAGR of 33.4% from 2016 to 2022 and reach $3,388 billion by 2022. Mobile payment refers to the payment for goods or services or transfer of money through mobile/smartphones. The mobile payment industry has evolved over the past decade with big brands entering the market and developing advanced technologies that provide the ease of payment using mobile/smartphones.

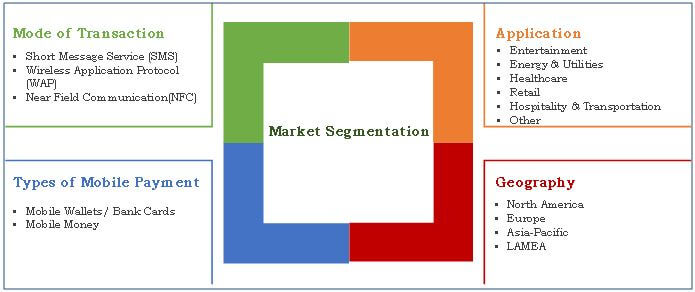

The global mobile payments market report provides analysis based on mode of transaction, mobile payment, application, and geography. By mode of transaction, the market is segmented into short message service (SMS), wireless application protocol (WAP), and near field communication (NFC). By type of mobile payment, the market is bifurcated into mobile wallets/bank cards and mobile money. Various applications of mobile payment include entertainment, energy & utilities, healthcare, retail, hospitality & transportation, and others. The market is further analyzed across geographical regions, namely, North America (U.S., Canada, and Mexico), Europe (UK, Germany, Switzerland, and rest of Europe), Asia-Pacific (India, China, Japan, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Market segmentation

Mobile wallets: An attractive segment driving the mobile payment market growth

Mobile wallet has high growth potential as it is a hassle free and cashless medium of payment. However, it is still a nascent market as customers are either not aware of its benefits or are reluctant to adopt the same. In a survey conducted by Accenture PLC, nearly 52% of North Americans are aware about mobile payments, yet only 18% use them on regular basis. However, attractive offers such as cash back or discounts, have caught the customer attention, thus, propelling the market growth.

The need for a cost effective and convenient payment mode has led to the development of new and innovative mobile transaction technologies and mobile applications such as Apple Pay and Samsung Pay. Apple Pay launched its services through more than two million retail stores, which highlights the growing acceptance of mobile payment by merchants. This service is currently available in UK, Australia, U.S., and Canada.

Mobile wallet has high growth potential as it is a hassle free and cashless medium of payment. However, it is still a nascent market as customers are either not aware of its benefits or are reluctant to adopt the same. In a survey conducted by Accenture PLC, nearly 52% of North Americans are aware about mobile payments, yet only 18% use them on regular basis. However, attractive offers such as cash back or discounts, have caught the customer attention, thus, propelling the market growth.

The need for a cost effective and convenient payment mode has led to the development of new and innovative mobile transaction technologies and mobile applications such as Apple Pay and Samsung Pay. Apple Pay launched its services through more than two million retail stores, which highlights the growing acceptance of mobile payment by merchants. This service is currently available in UK, Australia, U.S., and Canada.

Likewise, escalation in the usage of mobile phones in countries like India and China has encouraged service providers to provide for cashless payment options. For instance, in India, Uber has collaborated with Paytm for payment wallet owing to the proliferation in the usage of mobile wallets. In addition, to leverage the growing opportunities of the developing markets, Uber has plans to come up with its own mobile wallet in future, which would help the company to unlock more options for business growth.

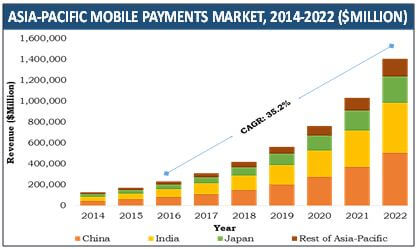

Asia-Pacific is a lucrative mobile payment market

The growing trend of m-commerce transactions accounts for growth in the ecommerce transactions in the region. The increase in online purchases using smartphones has fostered the mobile payment market growth. Moreover, the greater affordability of mobile phones over other mobile devices such as laptops, and the increasing internet penetration have led to the growth of mobile payments market.

The mobile technology is becoming an important part of customers’ daily lifestyle owing to the ease it offers for making diverse transactions. Mobile payments market share is gradually rising owing to the increasing awareness of mediums such as mobile banking apps and mobile wallets in the Asia-Pacific. These medium provide ease to make payments for any goods or services from anywhere across the world.

Countries such as Singapore, Australia, and Japan are some of the major markets which are preparing to become a cashless market in coming years. Mobile payment transactions through NFC technology is also anticipated to witness robust growth in Asia-Pacific, owing to the convenience in payment coupled with government initiatives towards a cashless society. For instance, China UnionPay, a China based bank card association in collaboration with China Mobile, the largest mobile network operator in the world, has launched an NFC payment service in over 14 cities in China to capitalize on the growing trend of mobile payment, thus fostering the growth of mobile payments market in the region.

Change in lifestyle, and the need for quick and hassle-free transaction

Rise in disposable income, hectic lifestyle, and penetration of mobile phones coupled with increased internet usage has encouraged people and companies to opt for mobile transactions as it is quick and hassle free. For instance, Starbucks Corp. launched the Mobile Order & Pay Program across the U.S. to enable customers to preorder and avoid waiting in long queues.

Similarly, MasterPass, is a digital wallet by MasterCard which would enable customers to make online payments, in-app, and in store across its various partners.

Thus, to cater the rise in demand for easy payment by consumers, many established players have launched new and innovative mobile apps and wallets. Thus, fostering the mobile payments market growth.

The key players profiled in the report include Orange S.A., Vodacom Group Limited, MasterCard Incorporated, Bharti Airtel Limited, MTN Group Limited, Safaricom Limited, PayPal Holdings, Inc., Econet Wireless Zimbabwe Limited, Millicom International Cellular SA and Mahindra Comviva. Other players in the value chain include One97 Communications Ltd., TIO Networks Corp, Google Inc (Google Wallet) and Apple Inc (Apple Pay).

Key Benefits of the Report

- A comprehensive analysis of the current trends and future estimations in the global mobile payment industry has been provided.

- This report elucidates on the key drivers, restraints, and opportunities along with a detailed impact analysis from 2014 to 2022.

- Porter’s Five Forces model of the industry illustrates the potency of the buyers and suppliers in the market.

- A quantitative analysis of the current scenario and the forecast period from 2016 to 2022 highlights the financial competency of the market.

- The report provides a detailed analysis of the global mobile payments market size with respect to mode of transaction, types of mobile payments, application, and geography.

- Value chain analysis in the report provides a clear understanding on the role of stakeholders involved in this process.

Mobile Payment Market Key Segmentation

The market is segmented on the mode of transaction, type of mobile payment, application, and geography.

By Mode Of Transaction

- Short Message Service (SMS)

- Near-Field Communication (NFC)

- Wireless Application Protocol (WAP)

By Type Of Mobile Payment

- Mobile Wallet/Bank Cards

- Mobile Money

By Application

- Entertainment

- Energy & Utilities

- Healthcare

- Retail

- Hospitality & Transportation

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Switzerland

- Germany

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- South Africa

Market Players in Value Chain:

- Orange S.A.

- Vodacom Group Limited

- MasterCard Incorporated

- Bharti Airtel Limited

- MTN Group Limited

- Safaricom Limited

- PayPal Holdings, Inc.

- Econet Wireless Zimbabwe Limited

- Millicom International Cellular SA

- Mahindra Comviva

- One97 Communications Ltd.

- TIO Networks Corp

- Google Inc (Google Wallet)

- Apple Inc (Apple Pay)