Breadcrumb

- Home

- Market & Technical Intelligence

- Life Sciences

- Report Information

Nerve Repair and Regeneration Market by Application (Neurorrhaphy, Nerve Grafting, Stem Cell Therapy, Neurostimulation Surgery), Products (Biomaterials, Nerve Conduits, Nerve Protectors, Nerve Wraps, Neurostimulation Devices)-Global Forecast to 2022

The nerve repair and regeneration market is segmented on the basis of product, application, and end user. The internal neurostimulation device market is subsegmented into spinal cord stimulation, deep brain stimulation, vagus nerve stimulation, sacral nerve stimulation, and gastric electrical stimulation. The spinal cord stimulation segment is expected to account for the largest share of the market in 2017. The growth in this segment is primarily attributed to increasing number of spinal cord injuries.

Based on nerve graft, the nerve repair and regeneration market is subsegmented into autograft, allograft, and xenograft. In 2017, the autograft segment is expected to account for the largest share of the market. This is because of short recovery time and technological advancement.

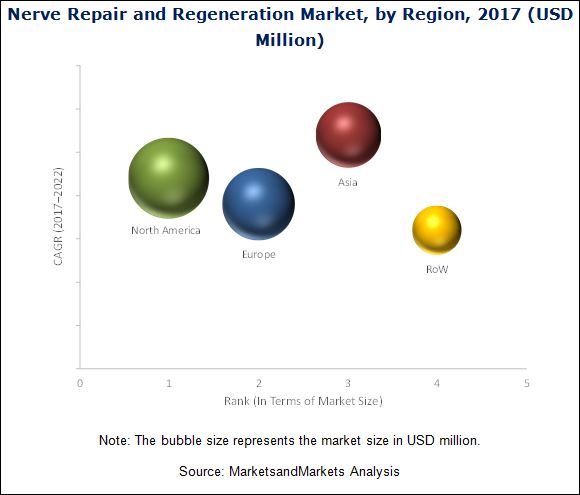

By region, the nerve repair and regeneration market is segmented into North America, Europe, Asia, and the Rest of the World (RoW). The market is dominated by North America, followed by Europe, however, the Asian region is expected to witness the highest growth during the forecast period. The presence of emerging economies like China and India; large population; growth in the number of hospitals, and increasing neurological disorders in the region are some of the key factors driving the high growth of this regional segment.

Lack of skilled and trained professionals is the major factor restraing the growth of the nerve repair and regeneration market. According to estimates from the American Academy of Neurology, there were 16,366 neurologists in the US in 2012, and this figure is estimated to reach 18,060 by 2025; however, the demand for neurologists in the country is projected to increase from 18,180 in 2012 to 21,440 by 2025. As a result, there will be a shortfall of about 3,400 neurologists (or a 19% drop in the total number of neurologists) in the country by 2025.

Medtronic (US), Boston Scientific (US), Abbott Laboratories (US), LivaNova (UK), Baxter (US), AxoGen (US), and Stryker (US) are the top players in this market. These companies have a broad product portfolio with comprehensive features and have a strong geographical presence.

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Nerve Repair and Regeneration: Market Overview

4.2 Asian Nerve Repair and Regeneration Market, By Application and Country

4.3 Geographic Snapshot of the Nerve Repair and Regeneration Market

4.4 Nerve Grafting Market, By Type

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Incidence of Nerve Injuries

5.2.1.2 Rising Geriatric Population and Subsequent Growth in the Prevalence of Neurological Disorders

5.2.1.3 Technological Advancements

5.2.2 Restraints

5.2.2.1 Greater Preference for Drug Therapies Over Nerve Repair and Regeneration Products

5.2.2.2 Dearth of Trained Professionals

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Potential of Stem Cell Therapy in Nerve Repair and Regeneration

5.2.4 Challenges

5.2.4.1 Donor-Site Morbidity

5.2.4.2 Difficulties in Treating Large Nerve Gaps

5.2.4.3 Stringent Regulatory Frameworks and Time-Consuming Approval Processes

6 Nerve Repair and Regeneration Market, By Product (Page No. - 32)

6.1 Introduction

6.2 Neurostimulation and Neuromodulation Devices

6.2.1 Internal Neurostimulation Devices

6.2.1.1 Spinal Cord Stimulation

6.2.1.2 Deep Brain Stimulation

6.2.1.3 Vagus Nerve Stimulation

6.2.1.4 Sacral Nerve Stimulation

6.2.1.5 Gastric Electrical Stimulation

6.2.2 External Neurostimulation Devices

6.2.2.1 Transcutaneous Electrical Nerve Stimulation

6.2.2.2 Transcranial Magnetic Stimulation

6.3 Biomaterials

6.3.1 Nerve Conduits

6.3.2 Nerve Protectors

6.3.3 Nerve Wraps

6.3.4 Nerve Connectors

7 Nerve Repair and Regeneration Market, By Application (Page No. - 45)

7.1 Introduction

7.2 Neurostimulation and Neuromodulation Surgeries

7.2.1 Internal Neurostimulation and Neuromodulation Surgeries

7.2.2 External Neurostimulation and Neuromodulation Surgeries

7.3 Direct Nerve Repair/Neurorrhaphy

7.3.1 Epineural Repair

7.3.2 Perineural Repair

7.3.3 Group Fascicular Repair

7.4 Nerve Grafting

7.4.1 Autografts

7.4.2 Allografts

7.4.3 Xenografts

7.5 Stem Cell Therapy

8 Nerve Repair and Regeneration Market, By End User (Page No. - 55)

8.1 Introduction

8.2 Hospitals & Clinics

8.3 Ambulatory Surgery Centers

9 Nerve Repair and Regeneration Market, By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.4 Asia

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Rest of Asia

9.5 Rest of the World

10 Competitive Landscape (Page No. - 83)

10.1 Introduction

10.2 Market Share Analysis

10.3 Competitive Situation and Trends

10.3.1 Regulatory Approvals

10.3.2 Mergers and Acquisitions

10.3.3 Product Launches

10.3.4 Agreements, Collaboration and Partnerships

11 Company Profiles (Page No. - 87)

(Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments)*

11.1 Axogen

11.2 Baxter

11.3 Boston Scientific

11.4 Livanova

11.5 Integra Lifesciences

11.6 Medtronic

11.7 Abbott Laboratories

11.8 Stryker

11.9 Polyganics

11.10 Nuvectra

11.11 Neuropace

11.12 Orthomed

11.13 Nevro

*Details on Marketsandmarkets View, Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 113)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (83 Tables)

Table 1 Nerve Repair and Regeneration Market, By Product, 2015–2022 (USD Million)

Table 2 Neurostimulation and Neuromodulation Devices Market, By Type, 2015–2022 (USD Million)

Table 3 Neurostimulation and Neuromodulation Devices Market, By Region, 2015–2022 (USD Million)

Table 4 Internal Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 5 Internal Neurostimulation Devices Market, By Region, 2015–2022 (USD Million)

Table 6 Spinal Cord Stimulation Devices Market, By Region, 2015–2022 (USD Million)

Table 7 Deep Brain Stimulation Devices Market, By Region, 2015–2022 (USD Million)

Table 8 Vagus Nerve Stimulation Devices Market, By Region, 2015–2022 (USD Million)

Table 9 Sacral Nerve Stimulation Devices Market, By Region, 2015–2022 (USD Million)

Table 10 Gastric Electrical Stimulation Devices Market, By Region, 2015–2022 (USD Million)

Table 11 External Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 12 External Neurostimulation Devices Market, By Region, 2015–2022 (USD Million)

Table 13 Tens Devices Market, By Region, 2015–2022 (USD Million)

Table 14 Tms Devices Market, By Region, 2015–2022 (USD Million)

Table 15 Biomaterials Market, By Type, 2015–2022 (USD Million)

Table 16 Biomaterials Market, By Region, 2015–2022 (USD Million)

Table 17 Nerve Conduits Market, By Region, 2015–2022 (USD Million)

Table 18 Nerve Protectors Market, By Region, 2015–2022 (USD Million)

Table 19 Nerve Wraps Market, By Region, 2015–2022 (USD Million)

Table 20 Nerve Connectors Market, By Region, 2015–2022 (USD Million)

Table 21 Nerve Repair and Regeneration Market, By Application, 2015–2022 (USD Million)

Table 22 Neurostimulation and Neuromodulation Surgeries Market, By Type, 2015–2022 (USD Million)

Table 23 Neurostimulation and Neuromodulation Surgeries Market, By Region, 2015–2022 (USD Million)

Table 24 Internal Neurostimulation and Neuromodulation Surgeries Market, By Region, 2015–2022 (USD Million)

Table 25 External Neurostimulation and Neuromodulation Surgeries Market, By Region, 2015–2022 (USD Million)

Table 26 Direct Nerve Repair/Neurorrhaphy Market, By Type, 2015–2022 (USD Million)

Table 27 Direct Nerve Repair/Neurorrhaphy Market, By Region, 2015–2022 (USD Million)

Table 28 Epineural Repair Market, By Region, 2015–2022 (USD Million)

Table 29 Perineural Repair Market, By Region, 2015–2022 (USD Million)

Table 30 Group Fascicular Repair Market, By Region, 2015–2022 (USD Million)

Table 31 Nerve Grafting Market, By Type, 2015–2022 (USD Million)

Table 32 Nerve Grafting Market, By Region, 2015–2022 (USD Million)

Table 33 Autografts Market, By Region, 2015–2022 (USD Million)

Table 34 Allografts Market, By Region, 2015–2022 (USD Million)

Table 35 Xenograft Market, By Region, 2015–2022 (USD Million)

Table 36 Stem Cell Therapy Market, By Region, 2015–2022 (USD Million)

Table 37 Nerve Repair and Regeneration Market Size, By End User, 2015–2022 (USD Million)

Table 38 Nerve Repair and Regeneration Market for Hospitals & Clinics, By Region, 2015–2022 (USD Million)

Table 39 Nerve Repair and Regeneration Market for Ambulatory Surgery Centers, By Region, 2015–2022 (USD Million)

Table 40 Nerve Repair and Regeneration Market, By Region, 2015–2022 (USD Million)

Table 41 North America: Nerve Repair and Regeneration Market, By Country, 2015–2022 (USD Million)

Table 42 North America: Nerve Repair and Regeneration Market, By Product, 2015–2022 (USD Million)

Table 43 North America: Neurostimulation and Neuromodulation Devices Market, By Type, 2015–2022 (USD Million)

Table 44 North America: Internal Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 45 North America: External Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 46 North America: Biomaterials Market, By Type, 2015–2022 (USD Million)

Table 47 North America: Nerve Repair and Regeneration Market, By Application, 2015–2022 (USD Million)

Table 48 North America: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 49 US: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 50 Neurological Conditions in Canada

Table 51 Canada: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 52 Europe: Nerve Repair and Regeneration Market, By Country, 2015–2022 (USD Million)

Table 53 Europe: Nerve Repair and Regeneration Market, By Product, 2015–2022 (USD Million)

Table 54 Europe: Neurostimulation and Neuromodulation Devices Market, By Type, 2015–2022 (USD Million)

Table 55 Europe: Internal Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 56 North America: External Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 57 Europe: Biomaterials Market, By Type, 2015–2022 (USD Million)

Table 58 Europe: Nerve Repair and Regeneration Market, By Application, 2015–2022 (USD Million)

Table 59 Europe: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 60 Asia: Nerve Repair and Regeneration Market, By Country, 2015–2022 (USD Million)

Table 61 Asia: Nerve Repair and Regeneration Market, By Product, 2015–2022 (USD Million)

Table 62 Asia: Neurostimulation and Neuromodulation Devices Market, By Type, 2015–2022 (USD Million)

Table 63 Asia: Internal Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 64 Asia: External Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 65 Asia: Biomaterials Market, By Type, 2015–2022 (USD Million)

Table 66 Asia: Nerve Repair and Regeneration Market, By Application, 2015–2022 (USD Million)

Table 67 Asia: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 68 China: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 69 Japan: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 70 India: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 71 RoA: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 72 RoW: Nerve Repair and Regeneration Market, By Product, 2015–2022 (USD Million)

Table 73 RoW: Neurostimulation and Neuromodulation Devices Market, By Type, 2015–2022 (USD Million)

Table 74 RoW: Internal Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 75 RoW: External Neurostimulation Devices Market, By Type, 2015–2022 (USD Million)

Table 76 RoW: Biomaterials Market, By Type, 2015–2022 (USD Million)

Table 77 RoW: Nerve Repair and Regeneration Market, By Application, 2015–2022 (USD Million)

Table 78 RoW: Nerve Repair and Regeneration Market, By End User, 2015–2022 (USD Million)

Table 79 Growth Strategy Matrix, 2014–2017

Table 80 Regulatory Approval, 2014–2017

Table 81 Mergers and Acquisitions, 2014–2017

Table 82 Product Launches, 2014–2017

Table 83 Agreements, Collaboration, and Partnerships, 2014–2017

List of Figures (31 Figures)

Figure 1 Research Design: Nerve Repair & Regeneration Market

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Nerve Repair and Regeneration Market Size, By Product, 2017 vs 2022 (USD Billion)

Figure 7 Nerve Repair and Regeneration Market Size, By Application, 2017 vs 2022 (USD Billion)

Figure 8 Nerve Repair and Regeneration Market Size, By End User, 2017 vs 2022 (USD Billion)

Figure 9 Nerve Repair and Regeneration Market Size, By Region, 2017 vs 2022 (USD Billion)

Figure 10 High Incidence of Nerve Injuries and Growing Prevalence of Neurological Disorders to Drive the Market Growth

Figure 11 Neurostimulation and Neuromodulation Surgeries to Dominate the Asian Nerve Repair and Regeneration Market in 2017

Figure 12 Asia to Register the Highest CAGR During the Forecast Period

Figure 13 Xenografts Will Continue to Register Highest Growth Rate During Forecast Period

Figure 14 Nerve Repair and Regeneration Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Neurostimulation and Neuromodulation Devices, the Largest Product Segment in the Market

Figure 16 Neurostimulation and Neuromodulation Surgeries Segment to Dominate the Market During the Forecast Period

Figure 17 Hospitals & Clinics Segment to Dominate the Nerve Repair and Regeneration Market During the Forecast Period

Figure 18 North America to Dominate the Nerve Repair and Regeneration Market in 2017

Figure 19 Asia to Register the Highest CAGR in the Nerve Repair and Regeneration Market During the Forecast Period

Figure 20 North America: Nerve Repair and Regeneration Market Snapshot

Figure 21 Asia: Nerve Repair and Regeneration Market Snapshot

Figure 22 Nerve Repair and Regeneration Market: Market Share (2016)

Figure 23 Axogen: Company Snapshot (2016)

Figure 24 Baxter: Company Snapshot (2016)

Figure 25 Boston Scientific: Company Snapshot (2016)

Figure 26 Livanova: Company Snapshot (2016)

Figure 27 Integra Lifesciences: Company Snapshot (2016)

Figure 28 Medtronic: Company Snapshot (2016)

Figure 29 Abbott Laboratories: Company Snapshot (2016)

Figure 30 Stryker: Company Snapshot (2016)

Figure 31 Nervo: Company Snapshot (2016)