Breadcrumb

- Home

- Market & Technical Intelligence

- IT / ICT Services & Solutions

- Report Information

IoT Chip Market by Hardware (Processor, Sensor, Connectivity IC, Memory Device, and Logic Device), End-Use Application (Wearable Devices, Building Automation, Industrial, Automotive & Transportation, and Others), and Geography - Global Forecast to 2022

Objectives of the Study

- To define, describe, and forecast the global IoT chip market on the basis of hardware, end-use application, and geography

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape for the market players

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia-Pacific, and Rest of the World

- To strategically profile the key players and comprehensively analyze market rankings and core competencies

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To provide a detailed Porter’s analysis and market life cycle analysis, along with technology and market roadmap for the IoT chip market

- To analyze the competitive developments such as joint ventures, mergers and acquisitions, new product launches, and research and development in the IoT chip market

- To map the competitive intelligence based on the company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions

To estimate the size of the IoT chip market, top-down and bottom-up approaches have been followed in the study. This entire research methodology includes the study of annual and financial reports of top players, presentations, and press releases; associations/consortiums such as Semiconductor Industry Association (SIA), IoT Acceleration Consortium (Japan), and European Research Cluster on the Internet of Things (IERC); paid databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource; and interviews with industry experts. Also, the average revenue generated by the companies according to the region was used to arrive at the overall IoT chip market size. This overall market size was used in the top-down procedure to estimate the sizes of other individual markets via percentage splits from secondary and primary research.

To know about the assumptions considered for the study, download the pdf brochure

The IoT chip market comprises players such as Intel Corporation (U.S.), Qualcomm Incorporated (U.S.), NXP Semiconductors N.V. (Netherlands), Texas Instruments Incorporated (U.S.), and Cypress Semiconductor Corporation (U.S.).

Target Audience:

- Raw material and manufacturing equipment suppliers

- Semiconductor wafer vendors

- Fabless players

- EDA and IP core vendors

- Foundry players

- Original equipment manufacturers

- ODM and OEM technology solution providers

- Distributors and retailers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

- Operating system (OS) vendors

- Content providers

- Software providers

IoT Chip Market Scope:

By Hardware

- Processor

- Microcontroller (MCU)

- Application Processor (AP)

- Digital Signal Processor (DSP)

- Sensor

- Accelerometer

- Inertial Measurement Unit (IMU)

- Heart Rate Sensor

- Pressure Sensor

- Temperature Sensor

- Blood Glucose Sensor

- Blood Oxygen Sensor

- Electrocardiogram (ECG) Sensor

- Humidity Sensor

- Image Sensor

- Ambient Light Sensor

- Flow Sensor

- Level Sensor

- Chemical & Gas Sensor

- Motion and Position Sensor

- Connectivity IC

- Ant+

- Bluetooth

- Bluetooth Smart/Bluetooth Low Energy (BLE)

- ZigBee

- Wireless Fidelity (Wi-Fi)

- Ethernet

- Near-Field Communication (NFC)

- EnOcean

- Cellular Network

- Wireless Highway Addressable Remote Transducer Protocol (WHART)

- Global Navigation Satellite System (GNSS) Module

- Thread

- Z-Wave

- ISA100

- Memory Device

- Static Random-Access Memory (SRAM)

- Dynamic Random-Access Memory (DRAM)

- Logic Device

- Field-Programmable Gate Array (FPGA)

By End-Use Application

- Wearable Devices

- Activity Monitors

- Smartwatches

- Smart Glasses

- Wearable Cameras

- Healthcare

- Fitness & Heart Rate Monitor

- Blood Pressure Monitor

- Blood Glucose Meter

- Continuous Glucose Monitor

- Pulse Oximeter

- Automated External Defibrillator

- Programmable Syringe Pump

- Wearable Injector

- Multi-Parameter Monitor

- Consumer Electronics

- Refrigerator

- Hi-Res Television

- Washing Machine

- Other Products

- Building Automation

- Occupancy Sensor

- Daylight Sensor

- Smart Thermostats

- IP Cameras

- Smart Meters

- Smart Locks

- Smart Grid

- Smoke Detectors

- Lighting Control Actuators

- Gateways

- Industrial

- Industrial Motes

- Automotive & Transportation

- Connected Cars

- Intelligent transportation systems (ITS)

- BFSI

- mPOS

- Kiosks

- Agriculture

- Wireless Sensors for Agriculture Application

- Retail

- Smart Beacons

- Oil & Gas

- Wireless Sensors for Oil & Gas

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- Rest of APAC

- Rest of the World (RoW)

- MEA

- Latin America

“This study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing the efforts and investments.”

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Country-wise breakdown of various geographies including North America, Europe, APAC, and RoW

- Market segmentation of various applications into product segments

- Comprehensive coverage of regulations followed in each region (North America, APAC, and Europe)

Company Information

- Detailed analysis and profiling of additional market players (up to five)

1 Introduction (Page No. - 19)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

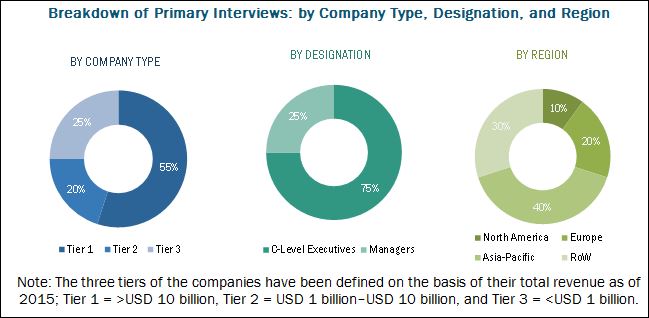

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Demand-Side Analysis for the IoT Chip Market

2.2.1 Demand-Side Analysis

2.2.1.1 Chip Demand Driven By Internet of Things (IoT)

2.2.2 Supply-Side Analysis

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the IoT Chip Market

4.2 IoT Chip Market, By End-Use Application and Country

4.3 Life Cycle Analysis, By Region

4.4 IoT Chip Market, By Geography

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Hardware

5.2.2 By End-Use Application

5.2.3 By Geography

5.3 Market Evolution of Internet of Things

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Demand for Application-Specific MCUs and Flexible Soc-Type Designs Owing to Growth of IoT

5.4.1.2 IPV6 Provides Better Security Solution Than IPV4 and ITS Adoption Leads to the Availability of More IP Address Space for the IoT Market

5.4.1.3 Growing Market of Connected and Wearable Devices

5.4.1.4 Growth of Low-Cost Smart Wireless Sensor Networks

5.4.1.5 Increasing IoT Investments

5.4.2 Restraints

5.4.2.1 Increasing Concerns Regarding Privacy and Security of Data

5.4.3 Opportunities

5.4.3.1 Government Funding to Promote IoT

5.4.3.2 Opportunities for Cross-Sector Collaborations

5.4.4 Challenges

5.4.4.1 Lack of Common Protocols and Communication Standards Across Platforms

5.4.4.2 High Power Consumption By Connected Devices

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

7 IoT Chip Market, By Hardware (Page No. - 60)

7.1 Introduction

7.2 Processor

7.2.1 Microcontroller (MCU)

7.2.2 Application Processor (AP)

7.2.3 Digital Signal Processor (DSP)

7.3 Sensor

7.3.1 Accelerometer

7.3.2 Inertial Measurement Unit (IMU)

7.3.3 Heart Rate Sensor

7.3.4 Pressure Sensor

7.3.5 Temperature Sensor

7.3.6 Blood Glucose Sensor

7.3.7 Blood Oxygen Sensor

7.3.8 Electrocardiogram (ECG) Sensor

7.3.9 Humidity Sensor

7.3.10 Image Sensor

7.3.11 Ambient Light Sensor

7.3.12 Flow Sensor

7.3.13 Level Sensor

7.3.14 Chemical and Gas Sensor

7.3.15 Motion and Position Sensor

7.4 Connectivity IC

7.4.1 ANT+

7.4.2 Bluetooth

7.4.3 Bluetooth Smart/Bluetooth Low Energy (BLE)

7.4.4 Zigbee

7.4.5 Wireless Fidelity (Wi-Fi)

7.4.6 Ethernet

7.4.7 Near-Field Communication (NFC)

7.4.8 Enocean

7.4.9 Cellular Network

7.4.10 Wireless Highway Addressable Remote Transducer (WHART)

7.4.11 Global Navigation Satellite System (GNSS) Module

7.4.12 Thread

7.4.13 Z-Wave

7.4.14 ISA100

7.5 Memory Device

7.5.1 Static Random-Access Memory (SRAM)

7.5.2 Dynamic Random-Access Memory (DRAM)

7.6 Logic Device

7.6.1 Field-Programmable Gate Array (FPGA)

8 Market, By End-Use Application (Page No. - 77)

8.1 Introduction

8.2 Wearable Devices

8.2.1 Products Covered Under Wearable Devices Application

8.2.1.1 Activity Monitors

8.2.1.2 Smartwatches

8.2.1.3 Smart Glasses

8.2.1.4 Wearable Cameras

8.3 Healthcare

8.3.1 Products Covered Under Healthcare Application

8.3.1.1 Fitness and Heart Rate Monitor

8.3.1.2 Blood Pressure Monitor

8.3.1.3 Blood Glucose Meter

8.3.1.4 Continuous Glucose Monitor

8.3.1.5 Pulse Oximeter

8.3.1.6 Automated External Defibrillator

8.3.1.7 Programmable Syringe Pump

8.3.1.8 Wearable Injector

8.3.1.9 Multi-Parameter Monitor

8.4 Consumer Electronics

8.4.1 Products Covered Under Consumer Electronics Application

8.4.1.1 Refrigerator

8.4.1.2 Hi-Res Television

8.4.1.3 Washing Machine

8.4.1.4 Other Products

8.5 Building Automation

8.5.1 Products Covered Under Building Automation Application

8.5.1.1 Occupancy Sensors

8.5.1.2 Daylight Sensors

8.5.1.3 Smart Thermostats

8.5.1.4 IP Cameras

8.5.1.5 Smart Meters

8.5.1.6 Smart Locks

8.5.1.7 Smoke Detectors

8.5.1.8 Lighting Control Actuators

8.5.1.9 Gateways

8.6 Industrial

8.6.1 Products Covered Under Industrial Application

8.6.1.1 Industrial Motes

8.6.1.2 Self-Learning Industrial Robots

8.7 Automotive and Transportation

8.7.1 Products Covered Under Automotive and Transportation Application

8.7.1.1 Connected Cars

8.7.1.2 Intelligent Transportation Systems (ITS)

8.8 Banking, Financial Services, and Insurance (BFSI)

8.8.1 Products Covered Under BFSI Application

8.8.1.1 Mobile Point of Sale (Mpos)

8.8.1.2 Kiosks

8.9 Agriculture

8.9.1 Products Covered Under Agriculture Application

8.9.1.1 Wireless Sensors for Agriculture Application

8.10 Retail

8.10.1 Products Covered Under Retail Application

8.10.1.1 Smart Beacons

8.11 Oil and Gas

8.11.1 Products Covered Under Oil Ang Gas Application

8.11.1.1 Wireless Sensors for Oil and Gas

8.12 Others

9 IoT Chip Market, By Geography (Page No. - 129)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 Rest of APAC

9.5 RoW

9.5.1 MEA (Middle East and Africa)

9.5.2 Latin America

10 Competitive Landscape (Page No. - 147)

10.1 Overview

10.2 Market Ranking Analysis 2016: IoT Chip Market

10.3 Competitive Situations and Trends

10.3.1 New Product Launches and Developments

10.3.2 Partnerships, Collaborations, and Joint Ventures

10.3.3 Acquisitions

11 Company Profiles (Page No. - 156)

11.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

11.2 Intel Corporation

11.3 Qualcomm Incorporated

11.4 NXP Semiconductors N.V.

11.5 Texas Instruments Incorporated

11.6 Cypress Semiconductor Corporation

11.7 Mediatek Inc.

11.8 Microchip Technology Inc.

11.9 Renesas Electronics Corporation

11.10 Stmicroelectronics N.V.

11.11 Huawei Technologies Co., Ltd.

11.12 Nvidia Corporation

11.13 Advanced Micro Devices, Inc.

11.14 Samsung Electronics Co., Ltd.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 202)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details