Breadcrumb

- Home

- Market & Technical Intelligence

- Consumer Goods

- Food & Beverage

- Report Information

Yeast Market - Global Trend & Forecast to 2021

USD 6,650 (Multi-User License)

USD 10,000 (Global-User License)

The global yeast & specialty yeast market is projected to reach USD 4.95 Billion in terms of value by 2021, at a CAGR of 8.9% from 2016 to 2021 and is projected to reach 3,115.2 KT in terms of volume by 2021, at a CAGR of 6.9%. Rising demand for bakery products and global demand for bio-ethanol as fuel are driving the market for yeasts. The market is also driven due to positive trend in alcoholic beverage consumption, which are among the major drivers for the yeast market. The global yeast market is segmented on the basis of type, form, application, species, region, speciality yeast by type, and speciality yeast by region. The objective of this study is to define, segment, and project the size of the yeast market based on its type, form, application, species, and region, and also provide detailed information about the crucial factors influencing market dynamics (drivers, restraints, opportunities, and industry-specific challenges).

The years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021

- Forecast Period – 2016 to 2021

This report includes estimations of market sizes for value (USD million) and volume (kilo tons). Both top-down and bottom-up approaches have been used to estimate and validate the size of the yeast & specialty yeast market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The various contributors involved in the value chain of yeast & specialty yeast include research institutes, manufacturers, suppliers, distributors, intermediaries, and end-use industries. The research institutes develop new variety or improved version of existing yeast strain by using advanced technology to make value additions. The manufacturers use their R&D facilities to run the pilot production and to check both pre- and post-processing impacts on the quality of the product and then it goes to the final customers. Maximum value addition is observed in the stages such as yeast selection, fermentation, and packaging. Yeast culture is suppled to various industries such as food and feed, and non-food industries such as pharmaceutical, bio-ethanol, and cosmetics, through the standard distribution channel.

The market is dominated by key players such as Associated British Foods plc (U.K.), AngelYeast Co., Ltd (China), Lesaffre Group (France), Chr. Hansen Holding A/S (Denmark), and Koninklijke DSM N.V. (The Netherlands). Other players in this segment include Lallemand Inc. (Canada), Alltech (U.S.), Leiber GmbH (Germany), Oriental Yeast Co., Ltd.(Japan), and Synergy Flavors (U.K.).

Target Audience:

- Raw material suppliers

- Suppliers of yeast strains and cultures

- R&D institutes

- Yeast research labs

- Yeast & specialty yeast manufacturers/suppliers

- Intermediary suppliers

- Wholesalers

- Retailers

- Dealers

- Consumers

- Food manufacturers

- Feed manufacturers

- Pharmaceutical companies

- Bio-ethanol manufacturers

- Retailers

- Research institutes and organizations

- Government bodies, venture capitalists, and private equity firms

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report

This research report categorizes the yeast & specialty yeast market based on type, application, form, and region.

Based on by Type, the market has been segmented as follows:

- Baker’s yeast

- Brewer’s yeast

- Wine yeast

- Feed yeast

- Bio-ethanol yeast

- Others (includes nutritional yeast and supplement yeast)

Based on Application, the market has been segmented as follows:

- Food

- Feed

- Others (includes pharmaceutical and industrial)

Based on Form, the market has been segmented as follows:

- Dry yeast

- Instant yeast

- Fresh yeast

- Others (includes bread machine yeast and rapid-rise yeast)

Based on Speciality Yeast, by Type, the market has been segmented as follows:

- Yeast extracts

- Yeasts autolysates

- Yeast beta-glucan

- Other yest derivatives (includes yeast flavor enhancers, yeast saccharides, and yeast pigments)

- Others (includes nucleotides, minerals, and vitamins)

Based on Speciality Yeast, by Region, the market has been segmented as follows:

- Europe

- North America

- Asia-Pacific

- RoW

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of food application in the yeast market

Regional Analysis

- Further breakdown of the Rest of World yeast market into Brazil, Argentina, South Africa, and Others in RoW.

- Further breakdown of the Rest of Asia-Pacific yeast market into New Zealand, Singapore, and Thailand.

- Further breakdown of the RoW yeast market into Persian Gulf countries and central Asia.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Table Of Contents

1 Introduction (Page No. - 18)

1.1 Objectives Of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Volume

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

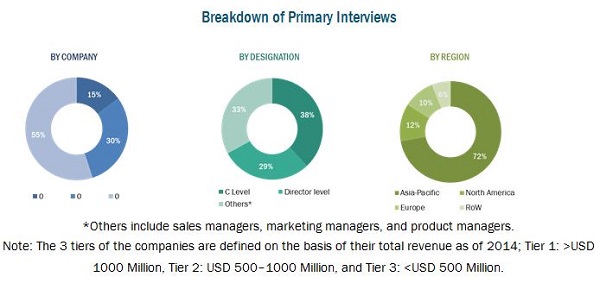

2.1.2.2 Breakdown Of Primaries By Company Type, Designation & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Disposable Income

2.2.2.2 Increase in the Production Of Beer

2.2.3 Supply-Side Analysis

2.2.3.1 Sugar Production

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in the Yeast Market

4.2 Key Yeast Markets

4.3 Life Cycle Analysis: Yeast Market, By Region

4.4 Yeast Market, By Application, 2016 vs 2021

4.5 Europe Yeast Market, By Counrty and By Application

4.6 Developed vs Emerging Yeast Markets, 2016 vs 2021

4.7 Yeast Market, By Type, 2015

4.8 Specialty Yeast Market, By Type, 2016 vs 2021

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Yeast Market

5.3.1.1 By Type

5.3.1.2 By Application

5.3.1.3 By Form

5.3.2 Specialty Yeast Market

5.3.2.1 By Type

5.3.3 Specialty Yeast Market, By Type

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rising Demand for Bakery Products

5.4.1.2 Positive Trend in Alcoholic Beverage Consumption

5.4.1.3 Global Demand for Bio-Ethanol as A Fuel

5.4.1.4 Increasing Demand for Specialty Yeast Products Due to Growth Of Processed Food Industry

5.4.2 Restraints

5.4.2.1 Food Safety Regulations for the Use Of Red Yeast Extract Products

5.4.2.2 Yeast Allergies Restrain Consumer From Consuming Yeast Based Products

5.4.3 Opportunities

5.4.3.1 Replacing Molasses With Other Raw Materials

5.4.4 Challenges

5.4.4.1 Competition for Basic Raw Material

6 Industry Trends (Page No. - 57)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain

6.3.1 Yeast Strain Origin

6.3.2 Yeast Strain Tests for Purity

6.3.3 Yeast Strain Storage and Preservation

6.3.4 Yeast Culture Supply

6.3.5 Quality Checks

6.3.6 Secure Shipping

6.4 Porter’s Five Forces Analysis

6.4.1 Threat Of New Entrants

6.4.2 Threat Of Substitutes

6.4.3 Bargaining Power Of Suppliers

6.4.4 Bargaining Power Of Buyers

6.4.5 Intensity Of Competitive Rivalry

7 Yeast Market, By Type (Page No. - 66)

7.1 Introduction

7.2 Baker’s Yeast

7.3 Brewer’s Yeast

7.4 Wine Yeast

7.5 Bio-Ethanol Yeast

7.6 Feed Yeast

7.7 Others

8 Yeast Market, By Form (Page No. - 80)

8.1 Introduction

8.2 Dry Yeast

8.3 Instant Yeast

8.4 Fresh Yeast

8.5 Other Yeast Forms

9 Yeast Market, By Application (Page No. - 92)

9.1 Introduction

9.2 Food

9.2.1 Bakery

9.2.2 Alcoholic Beverages

9.2.3 Non-Alcoholic Beverages

9.2.4 Prepared Food

9.2.5 Others

9.3 Feed

9.4 Other Applications

10 Yeast Market, By Region (Page No. - 107)

10.1 Introduction

10.2 Pest Analysis

10.2.1 Political Factors

10.2.2 Economic Factors

10.2.3 Social Factors

10.2.4 Technological Factors

10.3 North America

10.3.1 U.S.

10.3.2 Canada

10.3.3 Mexico

10.4 Europe

10.4.1 Germany

10.4.2 U.K.

10.4.3 France

10.4.4 Italy

10.4.5 Spain

10.4.6 Rest Of Europe

10.5 Asia-Pacific

10.5.1 China

10.5.2 Japan

10.5.3 India

10.5.4 Australia

10.5.5 Korea

10.5.6 Rest Of Asia-Pacific

10.6 RoW

10.6.1 Brazil

10.6.2 Argentina

10.6.3 South Africa

10.6.4 Others in RoW

11 Specialty Yeast Market, By Type (Page No. - 144)

11.1 Introduction

11.2 Yeast Extracts Market

11.3 Yeast Autolysates

11.4 Yeast Beta Glucan

11.5 Other Yeast Derivatives

11.6 Others

12 Specialty Yeast Market, By Region (Page No. - 153)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Rest Of the World (RoW)

13 Yeast & Specialty Yeast Market, By Species (Page No. - 166)

13.1 Introduction

13.2 Saccharomyces Cerevisiae

13.2.1 Bakery Application

13.2.2 Beverage Application

13.3 Pichia Pastoris

13.3.1 Healthcare Application

13.3.2 Methanol Prodcution

13.4 Kluyveromyces

13.4.1 Food Application

14 Yeast & Specialty Yeast, International Scenario (Page No. - 170)

14.1 International Trade

14.2 International Patent Scenario for Yeast

14.3 International Regulatory Framework

14.3.1 European Union

14.3.2 U.S.

14.3.2.1 Cfr - Code Of Federal Regulations Title 21

14.3.2.2 Nutritional Yeast Mact (40 Cfr Part 63, Subpart Cccc)

14.3.2.2.1 Compliance Requirements

14.3.2.2.2 Emission Limits:

14.3.2.2.3 Notification

14.3.2.2.4 Malfunction Plans

14.3.2.2.5 Pollution Prevention

14.3.3 Canada

14.4 Yeast Testing

14.4.1 Industrial Yeast Testing

14.4.1.1 Stress Exclusion Test

14.4.1.2 Ethanol Tolerance Test

14.4.1.3 Temperature Tolerance Test

14.4.1.4 Flocculation Test

15 Yeast & Specialty Yeast Industry Potential (Page No. - 179)

15.1 Introduction

15.2 Potential Raw Materials

15.2.1 Whey

15.2.2 Residues Of Forestry and Agriculture

15.3 New Yeast Species

15.4 New Yeast Applications

15.4.1 Uv-Treated Baker’s Yeast

16 Competitive Landscape (Page No. - 181)

16.1 Overview

16.2 Market Share Analysis: Global Yeast Market

16.3 Competitive Situation and Trends

16.4 Expansions & Investments

16.5 Acquisitions

16.6 Partnerships, Agreements, Collaborations, and Joint Ventures

16.7 New Product Launches

17 Company Profiles (Page No. - 188)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

17.1 Introduction

17.2 Geographical Revenue Mix Of Top Players

17.3 Associated British Foods PLC

17.4 Angelyeast Co., Ltd

17.5 Lallemand Inc.

17.6 Leiber GmbH

17.7 Lesaffre Group

17.8 Alltech

17.9 Chr. Hansen Holding A/S

17.10 Koninklijke DSM N.V.

17.11 Oriental Yeast Co., Ltd.

17.12 Synergy Flavors

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case Of Unlisted Companies.

18 Appendix (Page No. - 216)

18.1 Insights Of Industry Experts

18.2 Discussion Guide

18.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

18.4 Introducing RT: Real Time Market Intelligence

18.5 Available Customizations

18.6 Related Reports