Breadcrumb

- Home

- Market & Technical Intelligence

- Advanced Search

- Report Information

MIPI IP Survey - 2013-2017 Forecast

Publisher: IPnest

Published: 2013/10/22

Page: 49

Format: PDF

According with the MIPI Alliance, the year 2009 has been the time for MIPI specification to be developed, when 2010 was dedicated to Marketing and Communication effort to popularize MIPI technologies within the SC industry, finally the year 2011 was expected to see MIPI deployment in the Wireless Handset segment. The graph below (reproduced in the MIPI Organization web site "Overview") shows MIPI powered IC shipments (in red) compared with the total IC shipments in the wireless handset segment:

MIPI follows the trends in the Electronic industry: the massive move from parallel to serial interconnect, as illustrated by PCI Express replacing PCI, SATA replacing PATA, HDMI or DisplayPort replacing LVDS based interconnect to Display material (computer screen or HDTV) etc...

Using similar technologies in Mobile Devices is a natural move, but a specific attention has been taken to power consumption. MIPI has been specifically designed for portable electronic devices, battery powered, and lowering the power consumption is a key feature.

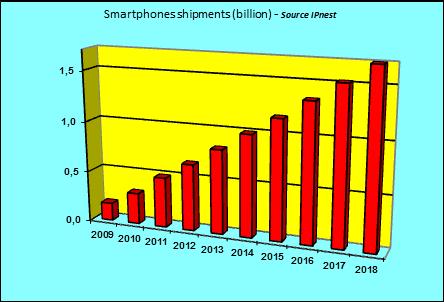

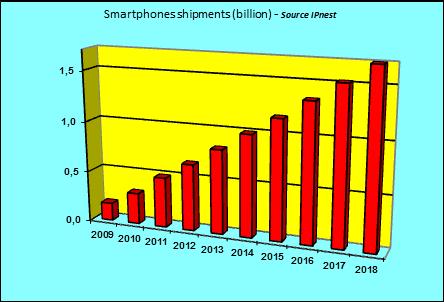

Even if MIPI as an IP market is still at the infant stage, the market is strongly growing in 2011-2013, starting in the wireless handset application, and more precisely in the Smartphone segment, which is by the way the most growing segment, seeing a 70% growth rate between 2010 and 2009, and 40% in 2011 to reach 490+ Million units shipment!

We expect 2012 smarphone unit shipment to have been in the 700 million...See below the Forecast built by IPNEST (frequently updated to cope with the incredible growth rate seen in this market segment).

At first, we are taking a look at the IC shipment, as this is the indicator that MIPI as a technology is mature enough to allow production level close to the Billion units in 2010. The MIPI technology has to be stable enough to allow such high production level, at every design stage: design integration and lay-out, manufacturing and last but not least, test in production.

Another factor, probably the most important for the adoption of an emerging technology, is the fact that "MIPI powered" IC pricing should go down, benefiting from the huge production quantities generated by the MIPI adoption in the wireless handset segment, compared with a similar IC not supporting MIPI.

Then you can take full benefit from MIPI usage:

Benefit from an up-to-date High Speed Serial Interface (equivalent to SuperSpeed USB, SATA 6G, PCIe gen-2) BUT at lower power consumption: MIPI specifications have been defined for low power

Standardized Interconnect protocol: an OEM can run seamless integration in the system of the different IC, providing they comply with the same MIPI Interfaces.

Interchange suppliers at low risk: an OEM can easily move from one IC supplier to another for the same function (for example a camera controller IC)

There are different specifications for the Controller (CSI, DSI, LLI and so on), but only two for the PHY (D-PHY and M-PHY): many specifications, but an easier learning curve to interface the application processor with Camera, Display, Modem, Mass Storage, WLAN, Remote Coprocessor...!

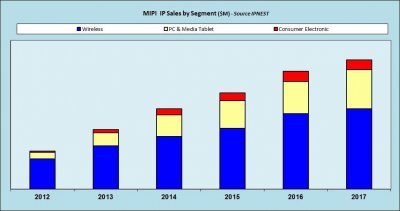

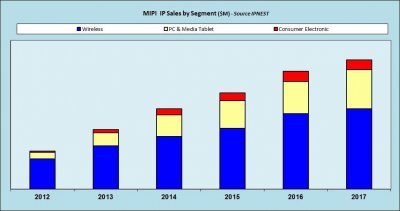

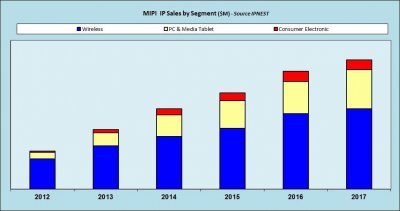

This is true for the Application processor (OMAP5 and OMAP4 from TI, Tegra 2 from NVIDIA, U9500 from ST-Ericsson...) which can be reused for other Mobile Electronic Devices and also for the peripheral ASSP supporting Camera, Display, Audio Codec or Modem applications. These MIPI powered price optimized ASSP can be also used in segments like PC (Media Tablet) and for Mobile Devices in CE, generating new MIPI IP business with chip makers serving these new segments. That's MIPI 'virtuous cycle!

The Tier 2 chip makers, playing in the wireless segment could minimize their investment in this new technology (need to build an AMS design team) and gain TTM by externally sourcing MIPI IP if they want to enter into the lucrative high end segment (Smartphone), which grew by 69% in 2011. MIPI pervasion in the above mentioned new segments would then be eased by the availability of "MIPI powered" ASSP and by off the shelf MIPI IP. Finally, the pervasion of MIPI should also occur in the mid range wireless handset (feature phones).